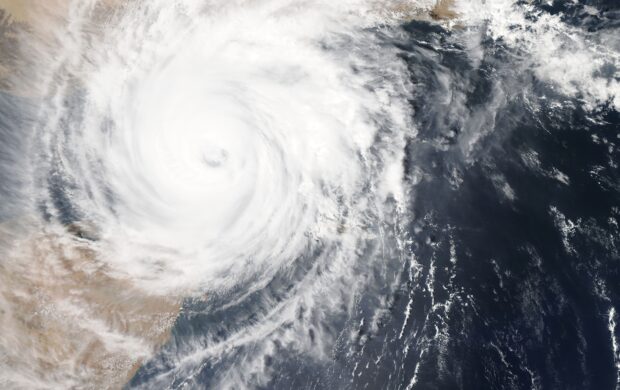

Oil majors, the old foes of the environmental movement, are starting to sell their drilling and extraction assets so that they can start to meet corporate transition targets. Private, even less virtuous money is waiting in the wings to snap up these assets.

So what?

The calculations for whether we are moving forward will need to be much more nuanced than counting the stream of glossy announcements about how companies are ditching their old ways. Vigilance is needed to track the behaviours of the organisations that pick up these assets. It is especially important since – in an effort to extract value from tired sites – they often resort to cutting even more corners than the majors did: allowing more leaks and spills.

As well as smaller organisations such as Hillcorp buying up BP’s Alaskan fields, there are some nation-states looking to increase their portfolio who represent much the same problem of being less accountable than what went before.

Focus, therefore, shifts back to how governments internationally can control supply and demand. Even if the big players answer to their better angels (and much protesting and financial self-interest), at the moment someone worse is coming along to have a go at making money from fossil-fuel ventures deemed too damaging or risky for some of the 20th Century’s greatest villains.

Sources

-

Selling Its Alaskan Oil Business Was a Green Win for BP—Not the Planet https://www.bloomberg.com/graphics/2021-tracking-carbon-emissions-BP-hilcorp/

Selling Its Alaskan Oil Business Was a Green Win for BP—Not the Planet https://www.bloomberg.com/graphics/2021-tracking-carbon-emissions-BP-hilcorp/ -

Energy Giants Ditch Oil and Coal Projects. Smaller Rivals Want Them. https://www.wsj.com/articles/energy-giants-ditch-oil-and-coal-projects-smaller-rivals-want-them-11618997401

Great signal! and yes, really points to the need for a strategy to retire the fields and infrastructure to avoid a fossil zombie problem…