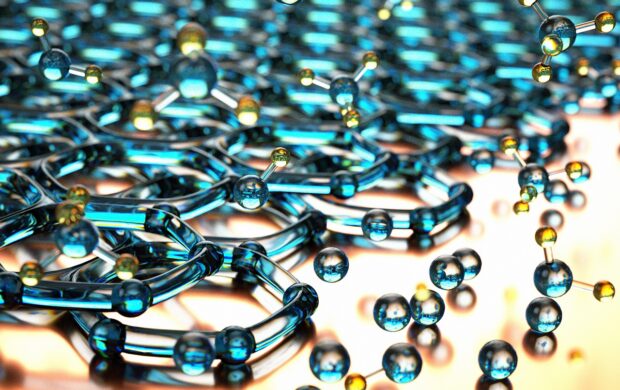

Nearly 400 million farms are dependent on rainfall to succeed, but only 3 percent are protected by insurance. Simon Schwall founded Oko to provide low-cost crop insurance for small farmers in rural Africa, with a mission to help overcome income distribution insufficiencies for those who feed the world.

So what?

Using index insurance, the company utilizes data analysis and risk calculation rather than onsite inspections to build a cheaper, more accessible policy for rural customers.

Join discussion